The compromise tax bill which was passed by Congress and signed by the President, extends until December 31, 2011, a provision known as the “Charitable IRA Rollover” which allows taxpayers age 70 1â„2 or older to make tax-free transfers (up to $100,000 per year) directly from their IRAs to charities (for example, your church, school or church ministries you wish to support). You can make distributions directly to one or more charities from your traditional IRA, as long as you are at least 70 1â„2 years old when you transfer the gifts. Such gifts can be made without increasing your taxable income or withholding. Additionally, funds transferred from your IRA to a charity will NOT subject your Social Security income to higher tax levels, and will count toward your minimum required distribution (MRD). For further information, call Robert Menard, Director of Planned Giving for the Catholic Foundation, 596-3043.

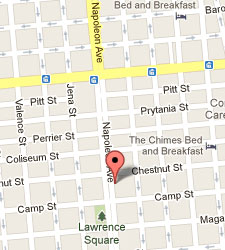

1025 Napoleon Ave, NOLA 70115

Rectory 504-899-1378 | Fax 504-899-0480

School 504-891-1927

ststephenpar@archdiocese-no.org

Rectory 504-899-1378 | Fax 504-899-0480

School 504-891-1927

ststephenpar@archdiocese-no.org

June 7, 2013 By

St. Stephen

Saturday Vigil at 4:00 pm

Sunday at 8:00 am and 10:30 am

Sunday at 5:00 pm at OLGC

Our Lady of Good Counsel (OLGC)

Center of Jesus the Lord

Charismatic Mass

Sunday at 10 am

Weekdays Masses

Monday – Friday 6:30 am St. Henry

Tuesdays 6:00 pm St. Stephen

First Fridays 6:00 pm Latin Mass

Adoration of the Blessed Sacrament

Tuesdays 4:45 – 5:45pm St. Stephen

Thursdays 7:00 – 8:00am St. Henry

Confession Times at Good Shepherd

Saturdays 3:00 – 3:45pm St. Stephen

Sundays 9:30 – 10:15am St. Stephen

Sundays 10:00 – 10:30am OLGC

First Fridays 6:30 – 7:00pm OLGC

Copyright © 2024 Good Shepherd Parish · New Orleans WordPress site hosting and maintenance provided by Amaze Media | Privacy Policy